Safeguarding Your Properties: Trust Fund Structure Experience at Your Fingertips

In today's intricate economic landscape, making certain the security and growth of your possessions is extremely important. Depend on foundations offer as a cornerstone for safeguarding your wealth and heritage, offering an organized technique to property protection.

Significance of Count On Structures

Trust fund structures play a vital duty in developing credibility and promoting strong partnerships in numerous professional setups. Building trust is vital for companies to prosper, as it forms the basis of successful cooperations and partnerships. When trust exists, people feel more confident in their interactions, causing increased productivity and efficiency. Depend on structures work as the keystone for moral decision-making and transparent communication within companies. By focusing on trust fund, businesses can produce a positive job culture where workers really feel valued and respected.

Benefits of Specialist Support

Building on the structure of rely on specialist connections, looking for expert assistance offers important advantages for individuals and companies alike. Professional advice gives a wide range of expertise and experience that can assist browse intricate economic, legal, or critical obstacles effortlessly. By leveraging the competence of specialists in various areas, individuals and companies can make enlightened choices that align with their goals and ambitions.

One significant advantage of professional advice is the capacity to accessibility specialized expertise that may not be easily offered or else. Professionals can offer understandings and perspectives that can cause ingenious remedies and chances for growth. Additionally, collaborating with experts can aid minimize risks and uncertainties by providing a clear roadmap for success.

Additionally, specialist support can conserve time and resources by streamlining processes and staying clear of pricey errors. trust foundations. Specialists can use customized advice customized to certain demands, making certain that every decision is knowledgeable and critical. On the whole, the advantages of professional advice are complex, making it a beneficial possession in safeguarding and making the most of assets for the long-term

Ensuring Financial Security

In the realm of financial planning, safeguarding a secure and flourishing future joints on strategic decision-making and sensible investment options. Making certain economic safety and security includes a diverse approach that encompasses various elements of wide range administration. One crucial component is creating a diversified financial investment portfolio tailored to individual threat tolerance and financial goals. By spreading investments across different possession classes, such as stocks, bonds, property, and assets, the danger of substantial financial loss can be mitigated.

Furthermore, keeping a reserve is necessary to safeguard against unforeseen costs or revenue interruptions. Professionals suggest alloting 3 to 6 months' well worth of living expenses in a liquid, easily available account. This fund functions as an economic safeguard, offering assurance during stormy times.

Routinely examining and adjusting financial plans in reaction to altering scenarios is additionally vital. Life have a peek at this website events, market fluctuations, and legislative modifications can impact financial security, emphasizing the relevance of recurring assessment and adaptation in the search of long-term economic safety - trust foundations. By carrying out these approaches attentively and continually, people can fortify their monetary ground and job towards an extra safe future

Safeguarding Your Possessions Effectively

With a strong structure in location for monetary safety with diversification and emergency fund upkeep, the following essential action is protecting your properties successfully. One effective approach is property allotment, which involves spreading your investments throughout numerous possession courses to reduce danger.

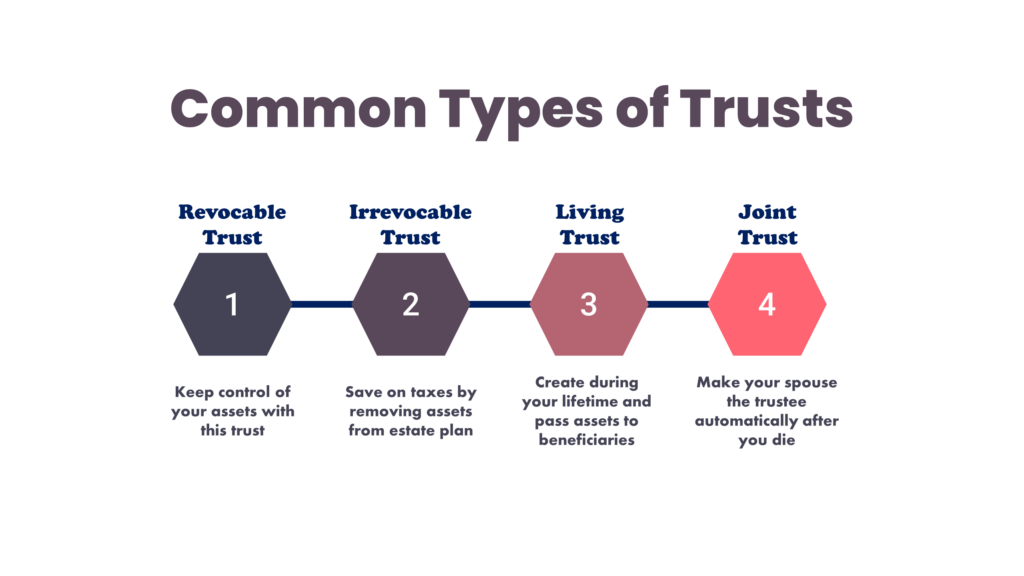

Additionally, establishing a trust can supply a secure method to secure your properties for future generations. Depends on can assist you regulate exactly how your properties are distributed, lessen inheritance tax, and shield your wide range from financial institutions. By implementing these techniques and seeking expert guidance, you can guard your possessions successfully and safeguard your economic future.

Long-Term Property Defense

Long-term property defense includes carrying out steps to secure your possessions from various threats such as financial declines, suits, or unanticipated life occasions. One crucial aspect of long-term property protection is establishing a depend on, which can offer considerable advantages in securing your properties from creditors and lawful disputes.

Moreover, expanding your investment portfolio is one more key technique for long-term property security. By spreading your financial investments throughout different asset courses, sectors, and geographical regions, you can lower the effect of market fluctuations on your overall wide range. In addition, regularly examining and upgrading your estate strategy is important to make sure that your possessions are protected his comment is here according to your wishes over time. By taking a proactive method to long-term possession protection, you can secure your wide range and offer economic protection on your own and future generations.

Final Thought

Finally, depend on structures play an essential duty in guarding assets and making certain economic security. Expert support in developing and handling count on frameworks is important for long-lasting property security. By using the competence of professionals in this area, individuals can my response effectively guard their assets and prepare for the future with confidence. Count on structures offer a strong structure for protecting riches and passing it on future generations.